My article on this topic.

https://www.linkedin.com/pulse/apple-push-uniform-pricing-india-aroop-dhar

26 Tuesday Apr 2016

Posted in Life

My article on this topic.

https://www.linkedin.com/pulse/apple-push-uniform-pricing-india-aroop-dhar

12 Tuesday Jan 2016

Posted in Business

Business models are getting disrupted by technology. Take the taxi space for instance. In the good old days, you needed to hail a cab and expect it to carry you to your destination. Cabs were dirty, drivers misbehaved and charged anything depending on how badly you wanted it. The industry had a disruption around 2007 when Meru came into being and its clones followed. They had radio taxi licence and the fares were regulated. The vehicles were owned by the companies and they charged a cut (like Rs 1000 / day or 20% of the revenues).

Cut to 2013: The startup Ola copied global model of Uber and launched its own app based system. Uber also got launched in 2014 to get a taste of India. These were just aggregators or platform providers: they matched the demand and supply sides giving greater efficiencies. They did not own the vehicles, allowing the driver to have an entrepreneurial flavor.

Today, we have a number of options: I did a comparison between the rates offered by 5 taxi companies to allow me to plan my trip.

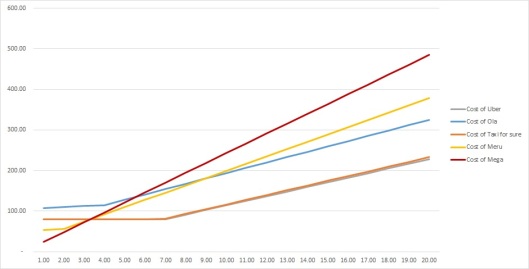

Here are the rates for sedans in Kolkata.

Assuming an average speed of 25 kmph and no surge, we have the following table containing what the trip would cost.

This is the graph containing the overall picture.

In times of high demand, there is a surge where the graphs will shift upward for the platform players. The graphs for radio cabs will disappear since cabs will not be available at all.

Here are my observations:

When I arrive at the airport, I have the following options:

My personal choice would be Uber, primarily due to its direct charges to credit cards.

Overall, the biggest gainer is Maruti, whose dzire tour cars are doing duty across platforms. Not to mention, commuters like us who do not want to be hassled by the taxi drivers.

08 Friday Jan 2016

I wonder how long we Indians will be taken for granted. We have a tendency to get attracted to lower prices (well, we consider overpaying as a personal insult). Yet we allow some practices to run with alacrity.

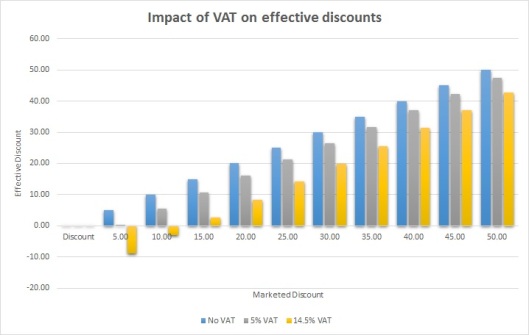

Consider this trend: There is a product, say a pair of jeans with an MRP of Rs 1000. The retailer (online or offline) announces a discount of, say 20% and then clarifies (in small font) that VAT would be applied on discounted products. At 5% VAT, the tax component comes to 800 x 0.05 = Rs 40.

The retailer charges Rs 840 after giving a discount of 20% on Rs 1000. A third grader can calculate that we are getting only 16% discount and not 20% as marketed. In what kind of mathematics impaired world do we live?

VAT is already built in the MRP. They calculate the price by discounting it, and then add the VAT again. Do they pay double tax? Hell, no! They just like to give us lower discounts but promise higher.

Unfortunately, retailers have been successfully running this show for some 4 years now.

Coming to formulas, let’s assume V is the VAT rate and D is the discount rate. The calculations would be:

Final price: MRP x (1 – D) x (1 + V)

Hence the discount is MRP – final price, or

MRP – MRP x (1 – D) x (1 + V), which comes to

MRP x (D-V+DV)

The effective discount rate = (D-V)+DV

The loss of discount due to the above strategy = V (1 – D)

So, in our above example, the effective discount rate = 20% – 5% + 1% = 16% and our loss is 5 (1-0.2) = 4%

I have plotted a graph comparing the advertised discount and the impact on VAT on the effective discount. I have considered 5% and 14.5% considering the two VAT rates are applied across India.

We can observe the following:

In short, businesses are cashing in on the consumer’s behavior: treating values smaller than 5% as loose change.

The ideal consumer products for this discounting and tax game are those which have

This includes branded apparel, footwear, electronics and many more (I am no tax expert). No wonder Shoppers Stop and its competitors are cashing in making this an industry norm.

There is a point at which the effective discount can be 0. At this point, we will have (D – V) + DV = 0 or D = V / (1+V)

When V = 5%, we can have a discount of D = 4.76% from the above equation.

Imagine a marketer saying “We are giving you a blockbuster discount of 4.76%, but unfortunately you have to pay VAT”. The final charges will be the MRP, then hopefully consumers will wake up and ask, “Where is my discount?”

19 Monday May 2014

Posted in Life

Online Pricing: The Dilemma before Electronics Brands

http://economictimes.indiatimes.com/tech/internet/online-pricing-the-dilemma-before-electronics-brands/articleshow/35336050.cms

Interesting article . I believe its time offline retailers start accepting the online wave.

09 Sunday Jun 2013

Posted in Business

Tags

In this changing IT world, companies often face temporary IT skill shortages. The void tends to get fulfilled by resourcing firms. Such contracts are often termed as ‘resource augmentation’ (as Accenture calls it) or a body shopping (in a crude form). There is little difference between the two. I wish to understand the issues faced by the service providers and the consumers of service.

The customers of IT services are companies whose competence lies elsewhere, and IT merely supports their operations. As an example, certain companies have annual budgets to invest in certain ERP solutions (a strategic decision from the CEO/CIO), but do not have the required team to execute the projects. In such a situation companies may choose to outsource the complete activity to a competent firm. On the flip side, once the implementation of the ERP solution is complete, the company would be locked in to the service provider’s whims. To avoid this situation, companies often prefer managing such IT projects internally. Internal management ensures that the control stays within the company. However, this alternative is expensive compared to outsourcing the activity completely to an external vendor. Hence only companies having substantial scale of operations (and budgets) can afford this practice.

To fulfill the demand, resource suppliers come into picture. Such companies have a pool of competencies from which suitable candidates are picked and sent to the client.

This kind of arrangement has some unique features. First, since the management lies with the client, the contract is of a T&M (time and material) nature. Clients are billed on a per hour, per day or per month basis against labor hours (or time sheets). There is little risk of cost overrun, since the only direct cost is the CTC of the employee. Secondly, the scope of the work is often not accurately defined, since the payments are based on time and not deliverables. This arrangement acts as a cash cow for IT service companies. Hence these have been extremely lucrative in a populous country like India.

The business model has attracted a number of IT service companies who consider such contracts as ‘bread and butter’. It requires little management effort on an ongoing basis. The prime focus of management is identifying a suitable resource and ensuring he/she stays put.

While this kind of set up appears lucrative, it is not without consequences. Due to lack of clear scope definition and the long duration of contracts, employees are expected to be with the client for years. In addition, clients often tend to be more demanding, since they feel they ‘own’ the vendors’ time. The resources may even be assigned repetitive work or no work at all. If the client has sufficient budgets, they prefer keeping the resource as long as then can. After all, someone conversant with the systems are more productive than someone who is not.

In knowledge industries such as IT, such situations tend to have debilitating effect on the employee morale, who is looking for food for thought. If the resource provider does not place due importance to the issue, it would result in dissatisfaction and ultimately attrition.

Companies involved in resource augmentation need to understand the growth aspirations of their employees, their interests and clearly define their employees’ career paths. This is easier said than done. Communication from the management becomes more important for such employees working under T&M contracts at client locations.

08 Saturday Jun 2013

Posted in Life

Today, every company has an IT strategy in place, thanks to the proliferation of ERP and the ever increasing sophistication of IT systems.

Some conglomerates having good bottomlines tend to secure their IT service reliability by spinning off companies which provide IT services to the core businesses. Such spin offs are either owned 100% by the parent or have a promoter holding of the parent. Some notable examples are ITC infotech, L&T infotech and Tech Mahindra, which have evolved into full service IT companies and do not depend exclusively on the parent for their revenues.

On the other hand, there are IT companies whose only source of revenue are the charge backs or internal payments from group companies for the services rendered. To avoid complications of transfer pricing, such companies have fixed hourly rates. Group companies are mandated not to receive IT services from outside, so service companies’ revenues are locked. Their charge back rates are normally higher than the market determined arm’s length prices.

This is a classic example of backward integration where a critical support service is managed from within the group. While the merits of such a setup are many, one of the demerits highlighted by Michael Porter is the ‘dulled incentives’ of the management. In his book, Competitive Strategy, Porter says, “The incentives for the upstream business to perform may be dulled because it sells in-house instead of competing for the business”

Due to the above features, the management of such companies end up managing costs rather than revenues or profits. Because of higher charge back rates and focus on the net profit obviated, they have higher expenditure budgets, which in turn implies more benefits for the managers and employees. Often this results in over hiring, which may result in employees fighting for assignments. Over hiring of managers would imply each manager tries to prove his/her importance and vehemently protect their fiefdoms, resulting in internal rivalry. Knowledge workers, who need food for thought struggle to keep themselves updated and engaged, face the dilemma of making a choice between benefits (that come from high budgets) and intellectual and professional growth (which is stunted since the work quality and quantity is poor).

This results in poor morale of the employees, resulting in high attrition rates. However, high budgets ensures arrogance of the management to get quick replacements, instead of looking into the root cause of the problem. The much desired positive spirit is lost and everyone is frustrated.

The way out of this is to either follow good transfer pricing practices (like negotiation between the IT service provider and the consuming company) or by allowing the IT service company to venture into the market to gain business and satisfy its shareholder(s) (termed as tapered integration by Porter). This will ensure that the service company’s hurdle rate is referred to while making any investment. Professional companies named above do the same, and are in a better position than the ones who do not.

I wonder how Porter knew in 1980 the issues which managers are facing today.

27 Monday May 2013

Posted in Life

Tags

Ebooks have become more of a fad in the past few years, thanks to the proliferation of the devices like kindle. Until 2012-13, ebooks never took off because kindle and its likes have been prohibitively expensive, and reading from a computer screen isn’t the most soothing for the eyes.

Yet with the introduction of tablets and smartphones with bigger screens, things are changing. Till sometime ago, e books to me were nothing but pdf documents downloaded (for free) over the Internet. These pdfs were great on the computer screen, and not too good for reading a novel (though great to fool the boss that you are doing something productive in office). And so the rule was: if I want to read a reference text (like wikipedia), I’d prefer online, but if its a novel or a text book, I would like to have the ability to read it while lying supine.

During my visit to Nigeria, and I met someone who was reading a novel on an old tablet (technologically outdated in 2 years). He couldn’t get a physical copy of ‘The immortals of Meluha’, so ebook was the only option. I found the concept mesmerizing. My recent technological upgrade to a nexus 7 introduced me to the concept of kindle app and google play and the ability to buy ebooks just like I would order physical books from flipkart.

I fell in love with it! And that’s because I found that it is:

Convenient – I do not need to carry (and dump) novels after reading them (think about lugging around multiple paperbacks)

User friendly – I can change the font size, the width of the line or spacing, brightness to suit my eyes and brain

Highlightable – I love marking important passages

Searchable – Now thats where technology comes in

Audible – A lot of apps can convert text to voice

Syncable across devices – That’s unique to ebooks. I read a novel on my tablet till page 277 and if I wish to continue reading on my laptop at office, I can do that due to its auto sync to farthest page read feature and ability to store bookmarks across devices

Editable – Yes, I can add comments just as easily like I would mark in a textbook using a pencil. These edits are visible when I view my ebook from anywhere.

Environment friendly – This goes without saying, cutting trees for paper isnt the best way to save the earth, nor is the logistical expense of printing and transporting books to the points of sale.

Copyright enforceable – But this is a tricky area. Digital rights management works but I hear that DRM can be stripped off and distributed. Not a good sign for authors and publishers.

And finally, cheaper – Because of its wide presence, differential pricing for the Indian market may not work, but they are still at par or slightly cheaper than their print counterparts. However, the difference is substantial in developed markets like the US. With the Indian market getting younger and eager to accept technology, ebook prices may fall further.

Some people still prefer paper books for the sake of legacy, but times are changing.

There are number of apps available for a tablet user (apple/android)

– Kindle

– Google play

– Kobo

– Aldiko

and more.

I found that amazon’s prices are lower than on google play. So whichever you choose, do it wisely.

A 7 inch tablet weighing less than 350g is ideal for ebook reading. There are many options in this range, make sure the battery life is good (ebooks do not consume a lot of battery anyway).

Going forward, I can see many great works getting converted to the ebook format. It would be interesting to see them coming.

I wouldn’t be surprised if school students these days read Shakespeare or Charles Dickens on tablets!

15 Friday Mar 2013

Posted in Life

Tags

Cobrapost informed us in many words, images and videos that such a website exists. All one could learn from the clandestine conversations what there the rules and systems, though fairly designed is not strong enough to check money laundering. A person deposits cash of 7-9 lakh in a bank with a copy of the pan card. The bank has no business in investigating his source of income, it is the income tax department`s prerogative. Bank officials know the weaknesses of the rules are are exploiting them. One may call it tactical.

02 Friday Nov 2012

Posted in Life

From http://www.projdemo.com/tata_mf/pss/PSS_Understanding_HardLanding.htm

Whenever I am on a plane and the landing is announced, I start feeling a little anxious about the impending touchdown. For there have been times when I have experienced a rough landing. Often we term such a landing as “hard landing”. Now the term hard landing has now found its way into economic dictionary.

So what does hard landing of the economy mean?

To understand this let’s look at why the aircraft has a hard landing. A hard landing occurs when the aircraft impacts the ground with a greater vertical speed and force than in a normal landing. Hard landings can be caused by weather conditions, mechanical problems, over-weight aircraft, and pilot error. The term hard landing usually implies that the pilot still has total or partial control over the aircraft.

Now let us compare this with the hard landing of the economy. The economy of a country is healthy when it experiences good levels of consumption and investments and when the mood of the people is exuberant. These are times when the economy experiences growth. As growth rates increase due to high consumer demand, prices of goods and services start to rise. This is an inflection point because the gates of the economy open up to inflation. Hereafter the central bank starts to apply the brakes by raising interest rates to start slowing down the economy gradually. Here the word, “gradually” assumes a lot of significance because the job of regulating interest rates by the central bank is indeed a very delicate one.

To understand this a little better, just imagine if the pilot were to inadvertently apply the brakes of the aircraft too hard. The consequences of such an action could be very damaging and the pilot could lose control over the aircraft causing it to skid and crash. Thus the pilot needs to regulate the brakes in such a manner that the aircraft lands smoothly.

In the same way, the central bank raising interest rates is akin to applying the brakes of the aircraft. If an increase in interest rates are regulated well, then slowly but steadily the economy will slow down and inflation will gradually get harnessed. Otherwise, the economy can go out of control and experience a sudden slowdown caused by undue negative sentiments, sudden slowdown in investments and slowdown in consumption and so on and so forth. This would cause immense pain in the economy due to low capacity utilization, job losses, and defaults, etc. This pain caused by mismanagement of the monetary policy is termed as “hard landing” of the economy.

Hope this analogy of the economy with an aircraft would have helped you get a decent grasp over the term “Hard Landing” of the economy.

11 Thursday Oct 2012

Posted in Business

Source link: http://www.projdemo.com/tata_mf/pss/PSS_Understanding_Underwriting.htm

Rakesh was aware that the students of the city were dying to see the Rock Band, “Spark” perform in Mumbai. So he approached his friend, Rohit, a seasoned businessman with the idea of hosting such an event. Rohit too felt that the idea was good and thought he could make a killing out of this. He decided to market the event. However, when he realized that the cost of marketing such an event was huge, he started getting cold feet.

He started to think, “What if he did not get a full house? What if it started raining on the day of the event?” He knew that only a packed house would become “news” that would benefit his interests and would help his reputation.

Sensing that indecisiveness was finding its way into Rohit’s mind, Rakesh went on an overdrive to ensure that Rohit does not back out. Rakesh was convinced about the success of the idea. He was not besotted with the kind of apprehensions that bothered Rohit. So he walked up to Rohit and proposed that he would buy the unsold tickets, if there would be any.

That assurance was good enough for Rohit to make his decision to go all out and invest the money in creating and marketing the event. This assurance of purchasing the unsold tickets is similar to what is popularly known as “Underwriting”.

In underwriting, in this context, a company is trying to raise money from the market by issuing shares. The underwriter is the person who helps the promoter in marketing the issue so that it either gets oversubscribed or 100% subscribed. In case of a shortfall, the underwriter purchases the outstanding shares.

Trust this story would give you an idea of the “UNDERWRITING” concept.